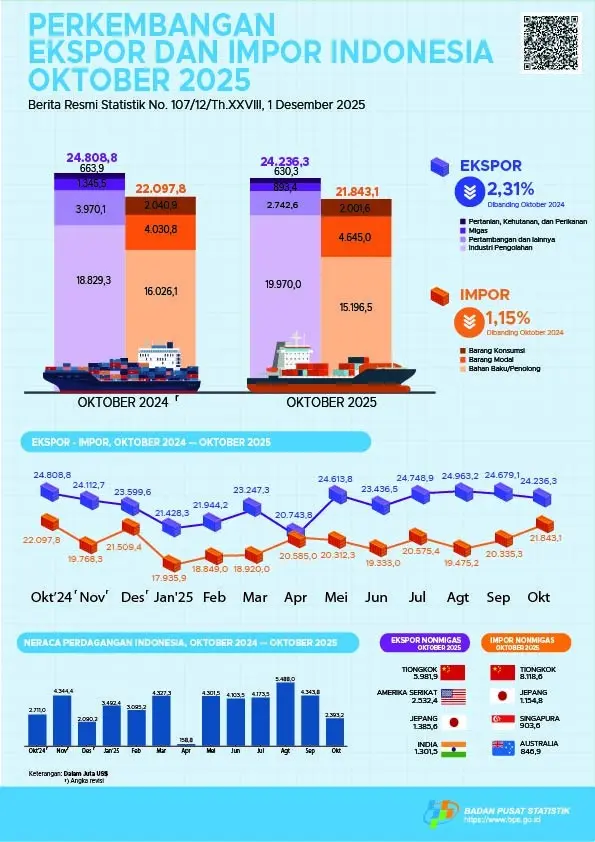

Indonesia demonstrated a resilient trade performance in October 2025, supported by strong industrial exports and stable import management amid an uncertain global economy. According to the Central Statistics Agency Official Statistical Report No. 107/12/Th.XXVIII published on December 1, 2025, the country’s total export value reached USD 24.236 billion, reflecting continued competitiveness across key economic sectors.

Economic analysts have praised Indonesia’s ability to maintain a positive trajectory despite external pressures. “Global trade has faced extraordinary disruptions over the past few years, yet Indonesia continues to show adaptability and upward momentum,” said a senior trade economist at the University of Indonesia.

The primary foundation of Indonesia’s export achievement lies in its manufacturing industry, which contributed USD 19.970 billion in October 2025. This dominant share reflects the success of downstream industrial policies especially in the processing of mineral resources such as nickel and copper, transitioning Indonesia from a raw-material exporter into a value-added production hub.

Meanwhile, the agriculture, forestry, and fisheries sector recorded encouraging performance with export contributions of USD 2.742 billion, driven by increasing global demand for sustainable food supplies and tropical products. Indonesia’s natural resources and rich biodiversity continue to offer competitive advantages in this sector.

The mining and extractive industries, contributing approximately USD 630.3 million as illustrated in the trade report, complement the industrial landscape by supplying essential inputs for manufacturing and global energy needs.

Indonesia’s import value reached USD 21.843 billion in October 2025, a 1.15% decrease from the USD 22.097 billion recorded in the same month the previous year. Instead of signaling weakness, economists interpret this contraction as evidence of more efficient industrial sourcing and stronger domestic production capabilities. A closer look at import composition also supports this interpretation.

The majority of goods brought into Indonesia during October 2025 were raw materials and intermediate products, valued at USD 15.196 billion. These inputs are essential for fueling industrial operations, showing that imports continue to play a productive role in the nation’s manufacturing growth. Meanwhile, capital goods amounted to USD 4.645 billion, suggesting that industries are still actively expanding and modernizing their facilities to enhance efficiency and technology readiness. By contrast, consumer goods accounted for only USD 2.016 billion, indicating the country’s growing ability to rely on locally produced products to satisfy domestic demand.

Data from the October 2024–October 2025 timeline reveal natural fluctuations, influenced by global shipping cycles and industrial production schedules. Export values peaked during May, June, and July 2025, likely driven by high demand in key markets, before stabilizing toward the end of the year. Import volumes followed a slightly different path, softening early in 2025 and rising in mid-year as industries replenished inventory and increased manufacturing activities.

Indonesia continues to strengthen its position in the regional economic network. China remains Indonesia’s largest export destination, receiving USD 5.813 billion in non-oil and gas shipments in October 2025. The United States follows at USD 2.933 billion, especially driven by manufactured and electronic goods, while Japan remains a key trading partner with USD 1.486 billion in export intake.

The persistence of a robust trade surplus, alongside deeper industrial integration and expanding global markets, shows Indonesia’s progress toward its long-term national ambitions particularly the Indonesia Vision 2045 agenda to rise among the world’s top economic powers by its centennial of independence.

Indonesia’s current economic footing suggests a promising future. As international competition intensifies, the country’s steady industrial transformation and strategic trade positioning will remain vital pillars for long-term sustainable growth. Translindo, as a reliable freight forwarder, stands ready to facilitate logistics solutions that connect Indonesian products to global markets. Through efficient shipping, compliance expertise, and integrated supply chain support, Translindo helps ensure that the nation’s expanding trade flows reach their destinations swiftly and securely.